You may have heard the idea that the Fed is trying to “thread a needle” with the economy by raising interest rates to slow growth but not cause a recession.

Well, we’re at crunch time with that plan. We’re at the point where the thread is passing through the eye of the needle.

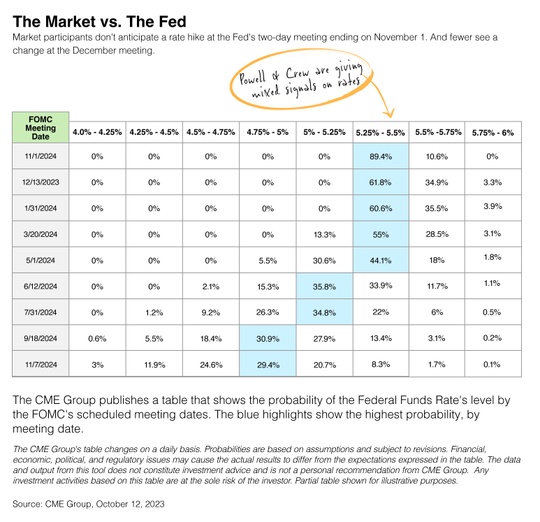

Fed Chair Jerome Powell has said one more rate hike may be necessary before the end of the year. But as you can see from the chart, market participants are calling his bluff and anticipating no more rate increases in 2023. (The Fed’s current target rate is 5.25% to 5.5%.)

In fact, so are other voting members of the Fed’s Open Market Committee, which decides on rate changes. Atlanta Fed President Raphael Bostic recently commented that he doesn’t see the need for more rake hikes. A short time later, Philadelphia Fed President Patrick Harker said he thinks the central bank can stop raising rates.1,2

The October inflation report didn’t appear to clarify the rates-inflation-economy debate. But the report did add a bit of confusion, and the delicate balance the Fed is trying to maintain.

The September Consumer Price Index was a bit hotter than expected, but the devil was in the details. For example, the CPI showed a +51% annualized increase in hotel prices. The month before, hotel prices showed a -43% annualized drop. So, the headline CPI needs to be taken with a grain of salt.3

The Fed has two meetings left this year. Let’s hope Powell & Crew can see through the confusion caused by some CPI inputs like “other lodging away from home including hotels” and reach a consensus on what’s next for rates.

1. Reuters.com, October 10, 2023. “Fed’s Bostic sees no more U.S. rate hikes, no recession.”

2. CNBC.com, October 13, 2023. “Philadelphia Fed President Harker advocates holding interest rates ‘where they are.’”

3. FundStrat.com, October 12, 2023.