The Federal Reserve has a dual mandate—manage inflation and maximize employment. But sometimes, those economic goals conflict with each other.

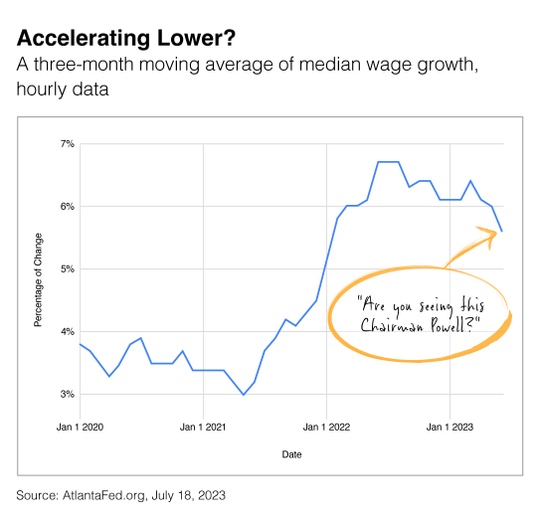

As you can see in the accompanying chart, labor shortages in 2022 pressured businesses to lift wages, which, in turn, put more money in people’s pockets. More money leads to more spending, which can produce inflation. So from the Fed’s perspective, employment improved last year, but inflation worsened.

But 2023 is telling a different story. Median wage growth is heading lower while inflation is dropping, which is precisely what Fed Chair Jerome Powell wants to see as he evaluates what’s next for short-term interest rates.

“I would say it’s certainly possible that we will raise funds again at the September meeting if the data warranted,” said Powell after the Fed’s July meeting. “And I would also say it’s possible that we would choose to hold steady, and we’re going to be making careful assessments, as I said, meeting by meeting.”

With wages lower and consumer prices trending down, we’re closer to the end of the rate-hike cycle than in the beginning. So stay tuned! The next Fed meeting is in September, but Federal Reserve officials will be making several speeches during the next few weeks.

- CNBC.com, July 26, 2023. “Fed approves hike that takes interest rates to highest level in more than 22 years.”

Gregrey Baker

[email protected]

503.280.7153

Integrity Wealth Management

LPL Financial Advisor

http://www.integritywmg.com